In a Nutshell

Annual percentage yield, or APY, shows the rate of return you earn on your money in a deposit account over a year after including the effect of compounding. You can use APY to make an apples-to-apples comparison of multiple deposit accounts.If you want to understand how much interest you can earn on your money, you’ll want to pay close attention to your bank account’s annual percentage yield, or APY.

Annual percentage yield is a term for the rate of return you get on your money after accounting for compounding interest. Depending on your bank, your interest may compound at different time periods. While one bank may compound interest daily, another bank may only compound monthly. The more frequently your interest compounds, the higher your APY.

Let’s take a closer look at APY and why it’s important.

- Is APY fixed or variable?

- How to calculate APY

- What’s the difference between APY and APR?

- What’s the difference between simple interest and compound interest?

- Compound interest example: Why APY is important

Is APY fixed or variable?

APY can be either fixed or variable, and it often depends on the type of deposit account you’re using. A variable APY will change, typically in line with the current market rates. It’s common to see savings accounts and money market accounts with variable APYs. A fixed APY, on the other hand, doesn’t change over the life of the account. Accounts like certificates of deposit typically have fixed APYs.

How to calculate APY

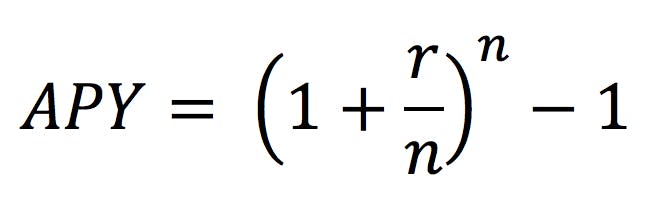

To calculate annual percentage yield, you’ll need to do a little math. APY is calculated using the following formula:

Image: what-is-apy_formula

Image: what-is-apy_formular = the annual interest rate

n = the number of times interest compounds per year

Thankfully, you don’t have to memorize this formula because banks are required to provide — and often advertise — the APY of their products.

What’s the difference between APY and APR?

APY and APR are similar terms, so it’s easy to mix them up. Certain economic factors can affect both of these rates, and understanding what each of them means can help you manage your finances as market conditions shift.

In short, APY gives you the rate at which your deposit account can earn money. You’ll encounter APY when opening an account where you’re depositing money, like a savings account.

On the other hand, APR, or annual percentage rate, calculates the annual cost of borrowing money — including certain fees. APR is a term to look out for when you’re taking out a loan or applying for a credit card.

Learn more about the difference between APY and APR.

What’s the difference between simple interest and compound interest?

An interest rate shows how much your money would grow over a specific period using simple interest. Simple interest does not include the effect of compounding.

Let’s say you deposit $10,000 in your bank account on January 1 and don’t touch it for the entire year. Your bank account has a 3% annual simple interest rate. This means it only pays interest once per year, at the end of the year. On December 31, your bank will add $300 to your balance for payment of the interest you earned.

Lucky for you, most banks don’t pay simple interest. Instead, most banks offer compound interest, which helps you earn more money. APY represents how much interest you’ll earn over the whole year after taking compounding into effect.

But what exactly is compound interest? It’s when you earn interest on money you put in the account and earn interest on the interest you’ve already earned. While this may sound complicated, it’s a good thing when it comes to building your savings in a bank account.

Compound interest example: Why APY is important

Let’s take the same $10,000 deposited into a bank account on January 1. But instead of simple interest, this time the bank offers a 3% interest rate that is compounded and paid monthly.

At the end of each month, the bank will deposit the interest you earn for that month into your account, rather than depositing interest just once at the end of the year. This means that on February 1, you’ll have your initial $10,000 plus the interest you earned in January ($25.48) in your account.

At the end of February, you’ll get another interest payment. But this time — assuming you didn’t withdraw any money from the account — you’ll earn interest on your initial balance ($10,000) plus the interest deposited at the end of January ($25.48).

So you’ll be earning interest on the interest you’ve already earned. This is what we mean by compounding. Over the course of the year, you’ll end up receiving $304.16 in interest rather than the $300 you’d earn with simple interest.

The $4.16 difference is why APY is important. If you simply compared two bank accounts that offer a 3% interest rate, you might think both offer the same earning potential for your money.

But once you examine how often interest compounds and use that information to calculate APY, you’ll realize the bank that compounds more frequently offers the best earning potential for your money as long as each bank’s interest rate is the same.

While compounding may not seem like a big deal over a few months, it can be a huge deal over longer time periods. Additionally, the more money you have, and the higher the interest rate, the bigger the difference that compounding interest will have over simple interest. That’s why banks use APY.

What’s next?

Understanding how APY works is an important step toward understanding how your money grows.

Once you’ve made sure you’re receiving a decent APY, take time to learn how compound interest and returns work over longer time periods. If you can get started saving and investing early, you may be surprised how much compounding returns can help your money grow.

FAQs about annual percentage yield

As of March 2024, some high-yield savings accounts range from around 4% APY to just over 5% APY. If you’re looking for a high-yield savings vehicle, it’s a good idea to compare different options. And take note that APY can vary with market conditions, so if rates are low, you probably won’t see very high rates on any accounts.

Look up several different high-yield savings accounts to compare their APYs. And when comparing APYs for a savings account, consider additional factors like the requirements for the accounts (such as a minimum deposit), the accessibility of the account (online-only vs. in-person options) and any fees associated with the account.