In a Nutshell

Writing a check can be intimidating if you never learned how — or haven’t done it in a while. Here’s a refresher.Writing a check is pretty simple, but you’ll need some information before you get started.

Gone are the days of writing checks for everyday transactions. But checks can still be necessary for things like paying rent or bills. Whether you’ve never written a physical check before or can’t remember the last time you did, this quick guide can help you understand how to write a check correctly.

Here’s what you’ll need to include when you write a check.

- The date

- The name of the person or company you’re paying

- The payment amount

- Your signature

- An optional memo, noting the reason for payment

Date

You’ll find the date field of your check in the top right-hand corner, right near the check number. You should enter the date on this line. If you decide to do it numerically, we recommend writing it in the DD/MM/YYYY format to help prevent confusion.

Image: how_to_write_check_date

Image: how_to_write_check_dateIn most cases you’ll simply enter the date the check is being written. But if you’re not quite ready for the funds to be withdrawn from your checking account, you can also “postdate” a check, which means entering a future date. For example, if you’ll be on vacation when your rent is due, you may want to submit your rent early but postdate your check.

Be careful with postdating, though. Postdating a check can encourage the recipient to wait before cashing or depositing the check, but according to the Consumer Financial Protection Bureau, banks and credit unions can generally cash checks before the written date. Whether a financial institution is required to respect the postdate varies by state. Some states provide that the bank or credit union shouldn’t cash the check before the date provided if you give it reasonable notice. Check your state’s laws to see what applies to you.

Recipient

In the field labeled “Pay to the order of,” you’ll enter the name of the check recipient or recipients. If you’re writing the check to an individual, make sure to include both their first and last name. If you’re writing the check to a business or organization, make sure to include its formal name.

If you’re not sure who’ll be cashing the check, you can write “cash” in this field. Just be careful: Anyone who gets ahold of a check made out to “cash” can cash it or deposit it.

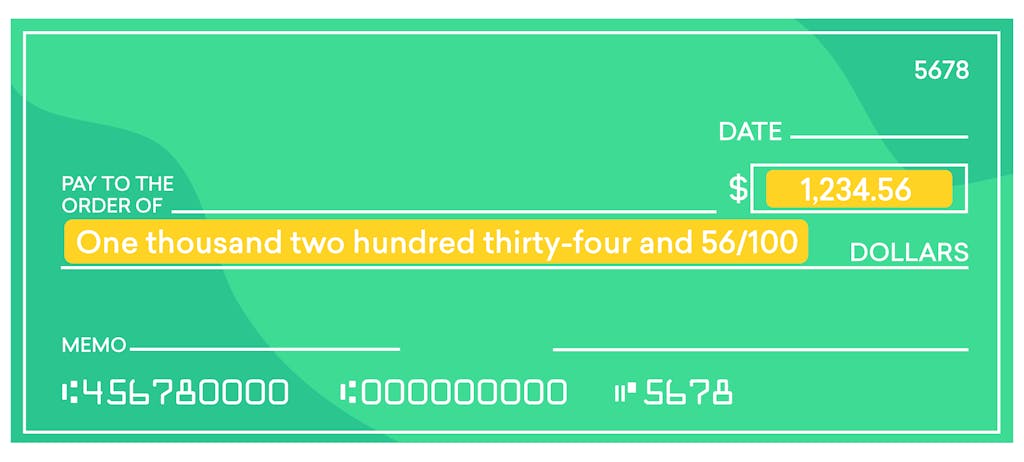

Payment amount

You’ll need to enter the payment amount in two separate fields. In the enclosed box next to the recipient line, enter the payment amount in numerals. Include both dollars and cents.

On the following line you’ll write out the payment amount. If your payment includes change, enter the change amount numerically as a fraction (change amount followed by “/100” — see example below). If by some mistake you write different amounts in the two payment fields, the amount you write out in words will be honored.

Image: how_to_write_check_amount

Image: how_to_write_check_amountSignature

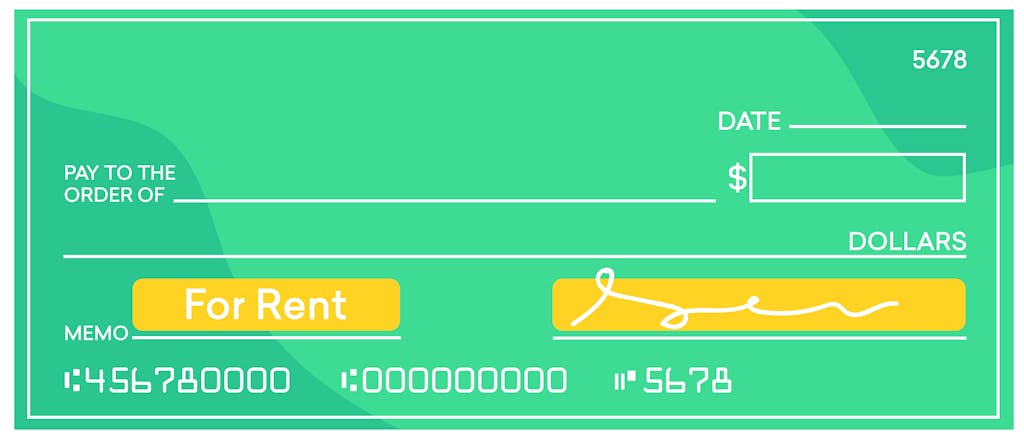

Finally, you’ll need to sign the check. Your signature goes on the line in the bottom right corner. It’s important not to overlook this step, since without your signature the check is considered invalid.

Image: how_to_write_check_signature

Image: how_to_write_check_signatureMemo (optional)

It’s not essential that you fill out this field, since it isn’t required to cash or deposit the check. But entering a memo can help you and the recipient keep clear records. When you write out your rent check, for example, you may want to include the month you’re paying for to help avoid any confusion for your landlord.

Should I keep a record of the checks I write?

After you remove a check from your checkbook, you’ll be left with a carbon copy, or duplicate, which you can keep for your records. But if you have access to online banking, you don’t necessarily need to hold on to that. If you need information about checks you’ve written, you frequently can view check images electronically through online banking services.

Bottom line

It’s not too difficult to write a check. Just make sure the lines and boxes have the right information in them.

One thing to note: When you write a check, the funds won’t be withdrawn from your checking account immediately. So make sure you have enough in your account to cover the amount until the check is cashed. As a rule, it’s a good idea to deduct the check amount from your spending budget as soon as you write a check. That way you won’t accidentally spend the funds you need to cover your check and have to deal with a bounced check or overdraft fees.